2021 Legal Asset Report: Construction industry insights

- International arbitration

In 2020, construction companies saw an uptick in both the value and number of disputes resulting from contractual obligations and third-party or force majeure incidents. While this is not entirely surprising given Covid-19’s disruption of global markets and supply chains, the numbers are noteworthy: According to Norton Rose’s 2021 Global Construction Disputes Report, the average construction dispute value rose sharply from $30.7 million in 2019 to $54.26 million in 2020.

With so much at stake given the increasing size and scale of construction disputes, companies in the sector are well served to be fully conversant in the tools that can help them maximize the value of their legal claims.

To better understand how finance professionals in the construction industry evaluate and leverage legal claims, The 2021 Legal Asset Report includes a snapshot for the sector. Below are the key takeaways:

Legal and finance professionals in the construction sector can benefit from closer collaboration

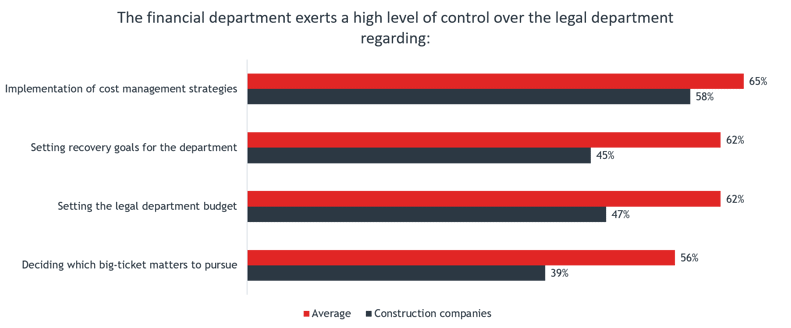

While 68% of financial officers in the construction industry recognize commercial claims as financial assets—the highest percentage when compared to other industries—they are the least likely to report collaborating with their legal departments to evaluate and select which claims to pursue. For example, only 39% of financial officers in the construction sector report having influence over decisions made about big-ticket litigation, and less than half report having control over recovery goals for their legal department.

With the increase in construction disputes in 2020 – and given that several of those disputes were worth billions of dollars – any missed opportunity to maximize the value of pending legal assets means that construction companies may be missing out on significant revenue. Based on research, CFOs and finance professionals in the sector recognize the value of pending legal assets and are eager to collaborate with their legal departments to enhance value to the business.

Legal and finance professionals in the construction sector can work together to make more informed decisions about legal assets

While construction sector finance departments report a lower level of influence over legal department decision-making than their peers in other sectors, construction CFOs and finance professionals are more likely than their peers in other sectors to conduct quantitative financial modeling of litigation. Nonetheless there remains significant opportunity for more modeling: 32% of CFOs and finance professionals in construction report conducting quantitative financial modeling, compared to 24% in other industries.

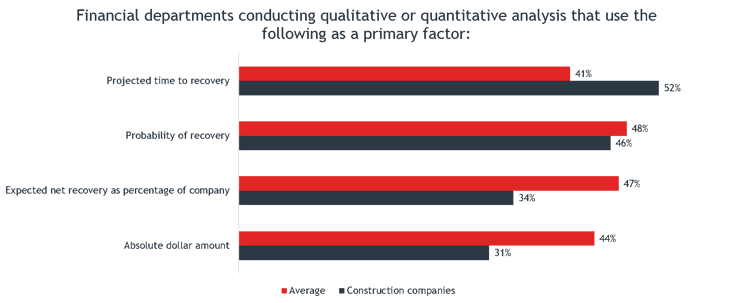

Interestingly, construction sector finance professionals are more likely than their peers to consider duration risk as the primary factor when making decisions about litigation. Duration risk (i.e., time to resolution) is critical when considering whether to pursue a claim, especially given that the process can cost companies millions in litigation fees and expenses that may not be returned through litigation or arbitration recoveries for many years. Well over half of construction companies chose not to pursue litigation because of cost, a factor that is only exacerbated over time.

Legal finance provides a unique solution to the age-old problem of duration risk by providing capital upfront, equipping companies for the long road to recovery. As capital is generally provided on a non-recourse basis, meaning repayment is contingent only upon a successful outcome, construction companies can quantify litigation without the pressures of duration risk and cost.

Legal finance can help construction companies take the next step

Construction companies are already taking the first step in recognizing the commercial value of legal assets and the insights from quantitative financial modeling of litigation. This is also reflected in the fact that majority of construction companies surveyed in the study report having affirmative recovery programs: 79% of finance professionals in construction report having “extremely” or “very” extensive affirmative recovery programs—formal programs that identify, track and assess recoveries secured by legal departments. Yet construction companies continue to leave millions on the table in commercial claims, which according to the 2021 Legal Asset Report average around $15.9 million dollars.

Given that legal departments are focused on staying on budget and that financial officers are wary of the risk of loss, construction companies can benefit from partnering with a provider to mitigate risk. Legal finance providers like Burford can help financial officers and CFOs take action and boost their affirmative recovery programs by alleviating the costs of the program and allowing construction companies to grow and pursue more opportunities through meritorious litigation.