Close, but no cigar: Key barriers to judgment and award enforcement

- Asset recovery

Collection and enforcement of a judgment debt from the losing side can be lengthy and expensive. Businesses spend years in a multi-year process and then, when they think they’re at the final whistle, it turns out that it’s only half time, and they have another three or four years to go before their opponent pays (if at all).

Collection and enforcement risk thus plays an important role in evaluating whether or not to pursue a claim. Businesses rarely recover the full value of their judgments and awards: Only 2% of senior in-house lawyers say they have recovered 100% of the value of their judgments and awards over the last five years.

Given that the judgment enforcement process can be a long and complex road, claimants should be aware of and prepared for a number of critical enforcement hurdles.

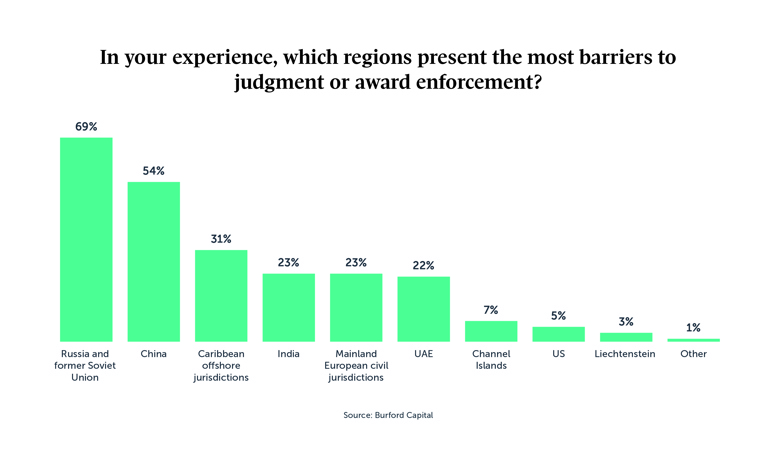

If most of the enforceable assets are located in an unpredictable jurisdiction, then it may raise concern not only as to the likely recoverability of the proceeds, but also the duration to recovery. Indeed, according to recent research, the top named reason by senior in-house lawyers (81%) for not pursuing judgments and awards was that the place of recognition was hostile to foreign judgments or awards. More than two thirds (68%) said they have had judgments and awards that could not be satisfied primarily because money was hidden offshore. Unsurprisingly, Russia and China were named as the two most difficult regions in which to enforce, with 69% and 54% respectively saying these jurisdictions have presented significant barriers to recovery.

Experts in asset recovery and enforcement understand the nuances of dealing with secretive or opaque jurisdictions. Often there is a key distinction between assets’ physical and legal locations. Additionally, judgment debtors with deep pockets are much more likely to have geographically dispersed assets that are hidden in complex corporate structures.

When dealing with challenging jurisdictions, it is best to try and find an international solution to get debtors to settle. The key to successful collection is not necessarily enforcing against a single bank account or asset but developing a multi-prong strategy that involves investigation and proceedings in multiple jurisdictions to incentivize and put pressure on the judgment debtor to settle.

Judgment debtors with an international profile will often have international assets such as yachts, properties and offshore accounts that offer up an opportunity to restrain and recover assets outside of their home jurisdiction. Frequently, the genesis of the dispute or the nationality of the debtor is a red herring when it comes to where their primary assets may be.

When dealing with debtors in China and Russia, it may make sense to look for solutions outside of those jurisdictions, restraining assets in other typical locations for assets, such as New York, London, Switzerland, Liechtenstein and offshore tax havens.

Finding and identifying relevant assets against which to enforce is a challenge all its own. Nearly two thirds (64%) of in-house lawyers say that the inability to identify or assess the assets of debtors is an important hurdle that contributes to the decision not to pursue a judgment or award.

Experts in enforcement can investigate and trace assets for judgments and awards, as Burford does on our investments. This involves examining public records, data aggregation and leveraging legal discovery and disclosure rules in various jurisdictions to pull together a footprint for the debtor. To get a full understanding of what are often deliberately opaque structures and interests, Burford’s team generally finds a full suite of investigative approaches is needed.

Increasingly we are seeing an increase in recovery activity against judgment debtors that are choosing not to pay, as opposed to those who simply don’t have the money. A significant majority of senior in-house lawyers (62%) say that their opponents voluntarily pay their outstanding judgments and awards less than 50% of the time and only 9% of judgment debtors pay on time.

Unfortunately, debtors frequently seek to evade payment, dodge service and plead poverty to draw out the enforcement process, aiming to rack up pursuit costs and delay collection until creditors eventually give up. Common tactics include cannibalizing enforceable assets by transferring assets at undervalue to friends or family or reducing the asset’s equity by leveraging against it. Debtors may also draw out the recovery process by filing frivolous counter or competing claims with the ultimate aim of driving down the settlement price. As judgment debtors grow more creative in leveraging the above tactics, pursuing enforcement strategies becomes lengthier, riskier and more expensive. Expertise in such tactics is needed to bring recalcitrant debtors to the table.

The cost of bringing enforcement proceedings and ultimately recovering a judgment or award can itself be prohibitive. Indeed, the high cost of enforcement and recovery is the second most important hurdle cited by in-house lawyers (74%) as to whether or not to pursue a judgment or award.

This makes sense: Claimants that have already been burned twice—first, by the initial litigation, and second, by the failure of the judgment debtor to pay the award or settlement—can be loath to add insult to injury by incurring the cost of enforcement and recovery.

Given the sometimes substantial and unanticipated cost of recovery once a judgment is obtained, not to mention the risk inherent in any enforcement procedure, asset recovery finance is becoming an increasingly popular tool for law firms and their clients. The legal finance provider covers the costs of recovery, including legal and other costs, in return for a proportion of the damages recovered. Because finance is provided on a non-recourse basis, the judgment creditor’s risk exposure is minimized, while retaining significant upside in the event of a successful enforcement.

Claimants are increasingly seeing the benefits of this type of financing: 77% of senior in-house lawyers cited immediate liquidity and working capital, and 72% cited reduced costs, as important benefits of funded enforcement. While there are a number of different forms that asset recovery financing can take, ultimately a hard-won judgment should not go unpaid simply because the defendant refuses to pay and the claimant runs out of steam.

Reprinted with permission from the December, 14, 2023 edition of Law.com International © 2023 ALM Global Properties, LLC. All rights reserved. Further duplication without permission is prohibited, contact 877-256-2472 or [email protected].