2021 Legal Asset Report: The pharmaceutical industry

The 2020-21 pandemic has put pharmaceutical and life sciences companies at center stage as they worked to solve the public health crisis with a surge of research, innovation and business collaboration.

Following the pressure to deliver results over the last year, pharmaceutical companies are now putting a renewed focus on research and development (R&D). And with more need to protect working capital for R&D, companies must remain vigilant in managing the legal costs that come with both new products and protecting existing products.

In an effort to better understand whether and how finance teams across industries and geographies are working with legal to maximize the value of corporate litigation assets, Burford commissioned the 2021 Legal Asset Report. The report includes a pharmaceutical and life sciences industry snapshot, which looks at how CFOs in these sectors view their legal assets. Below are the key takeaways:

Product development presents enormous cost and risk to pharma and life sciences companies, and patent enforcement through litigation is necessary and expected. It’s not surprising then that finance professionals in the sector report more extensive affirmative recovery programs compared to other industries. What is surprising is that so few are satisfied with them: Just 38% of finance professionals in the pharma and life sciences sector say their recovery program meets their company’s needs, significantly below average.

Even if companies with robust recovery programs can afford litigation, they may find that their capital could generate a better return if invested elsewhere in the business. Legal finance providers can help companies fund recovery programs without risking their own capital.

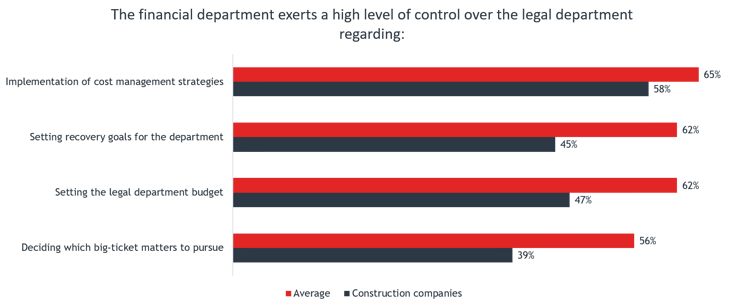

81% of financial officers in pharma and life sciences report exerting a high level of control over setting recovery goals for the legal department. This and other areas of collaboration between finance and legal teams reinforce the importance of having a commercial mindset when approaching litigation—and adding even more value to the business.

A close relationship between finance and legal is key to setting value-add goals alongside cost-control goals. Companies gain more value from their legal departments when finance and legal leaders encourage more commercial thinking about litigation in general—for example, by designing affirmative recovery programs that return value to the business through meritorious litigation. With outside legal financing in place, companies can do so in ways that eliminate affirmative litigation cost and also offset litigation defense costs.

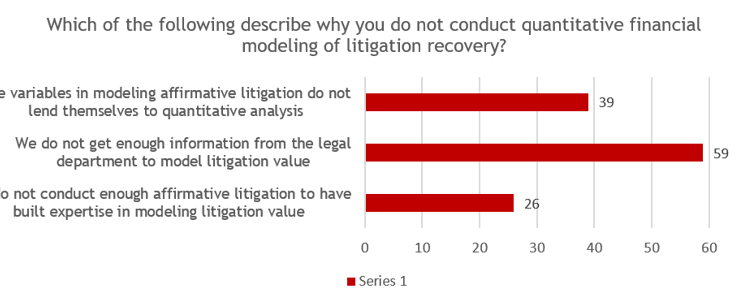

65% of pharma and life sciences finance officers report that their teams make qualitative decisions or recommendations on potential litigations, but just 27% report that their finance departments conduct quantitative financial modeling of litigation with the same rigor as in other decisions in the business.

While pharmaceutical companies’ finance and legal departments are more aligned compared to other industries, their decision making process could be negatively and unnecessarily impacting their balance sheets.

Given that qualitative decision making currently outweighs quantitative modeling, CFOs in the sector have an opportunity to consider new tools to value litigation assets and make decisions on how they pay for and leverage their legal assets.

However, few companies litigate with enough frequency to have built expertise in key aspects of case budgeting and quantitative modeling for litigation costs and outcomes, and their data sets will by definition be limited to their own experience. Legal finance providers are able to deliver this expertise and data, along with capital to finance affirmative recovery efforts and help secure valuable awards for future operations.