2021 Legal Asset Report: Mining industry insights

- International arbitration

The ongoing disruption of the pandemic continues to exacerbate the business pressures faced by of the mining industry, already rife with volatility due to supply chain disruptions, political and regulatory changes and taxation issues. Consequently, mining companies are often subject to large-scale disputes over a variety of reasons. It is no surprise that mining disputes accounted for the majority of investor-state arbitration cases in 2020. Mining disputes often involve multiple parties across jurisdictions, increasing the cost and duration to resolve cases. However, the awards at stake can be worth billions. In fact, several of the largest awards on public record have been from mining disputes.

Given that the mining sector is vulnerable to numerous external forces, maximizing the value of pending legal assets is of paramount importance. The 2021 Legal Asset Report suggests how CFOs in mining companies can approach pending legal claims to extract greater value. Below are some of the highlights from the research:

CFOs need to recognize pending claims as legal assets

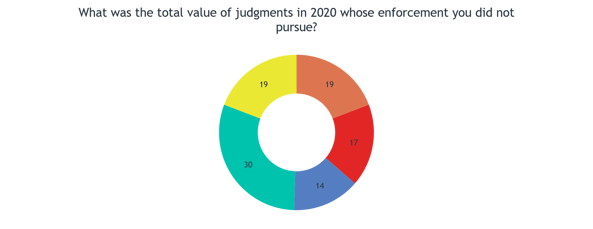

In 2020, 49% of CFOs reported that they left unenforced judgments on the table; almost half of those judgments were valued at $20 million or higher. Considering that the average mining company spends 1.1% of their revenue on legal costs alone, CFOs of mining companies stand to lose billions that could otherwise be put towards sustaining their businesses and investing in new projects and technologies.

Like other facets of the business, CFOs can also apply a commercial mindset to their pending legal claims. While the majority of CFOs report having extensive legal cost management and affirmative recovery programs, which respectively focus on reducing legal costs and generating additional value, there is further opportunity. Among the areas of opportunity: Conducting quantitative analysis of legal assets from the outset, and thereby understanding the future value of present day claims.

Conducting quantitative financial modeling of legal assets

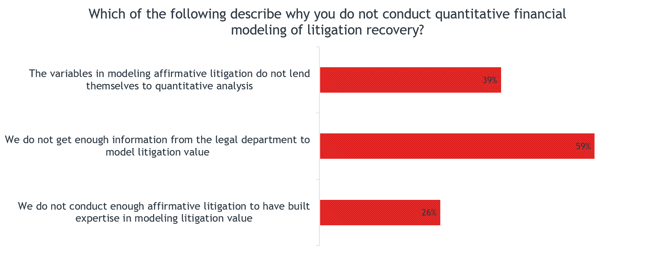

59% of CFOs pointed to a lack of information as the main deterrent for conducting quantitative financial modeling. Interestingly, CFOs of larger companies are much less likely to believe that financial modeling of legal assets is possible. They choose only to track ongoing litigation costs rather than projections of net recovery, which provides a one-sided view of the benefits and value of affirmative litigation in boosting overall revenue.

Increased collaboration between legal and financial departments is a first step. Finance and legal departments of mining companies can work with their law firms and a legal finance provider to better identify and evaluate their assets.

Legal finance can provide certainty in a highly volatile business

Mining is an industry vulnerable to risk. The mining industry saw their net profit margin drop to an all-time low last year, from 25% in 2010 to a mere 11% in 2020. Many mining companies have had to stall business operations and forego profits while shouldering the additional expenses of processes, health protocols and support for their workforce. This is especially true for the top 40 global mining companies, which employ tens of thousands of employees.

Legal finance is well equipped to assist mining companies facing revenue uncertainty by providing the analysis and capital they require to maximize the value of their litigation assets. From financing single high-risk matters to providing capital for a range of matters in portfolio financing, reputable providers such as Burford can help CFOs and legal departments identify and optimize their assets without taking on any additional risk.